Chronik Saga EP1 – Who is Chronik?

For those of you unaware, I’ve been trying to start a prop firm. Lot’s of influencers are doing it. It’s the thing.

I, however am not building a funding program, often mistaken as a proprietary trading firm. You usually don’t get any benefits other than capital. No accountability, guidance, technology, or secret sauce.

Really, if you ask me most are bucket shops. They are a necessary evil for some, and a scratch off ticket for others.

Personally, I think that route is a great way to get capital if you know what the fuck you’re doing; otherwise…. you can turn into a gambling addict which there’s a lot of you doing that.

Look, you do these when you have developed consistency on sim. You don’t need to learn on them, but impatience is the retail traders number one kryptonite. I mean who in their right mind will attempt to learn for years before attempting a go at real money?

What I’m trying to achieve is not capital. In fact we are leveraging another combine for capital. The split is 50/50 between me and the trader. I take the split hit from the combine we are leveraging. So really it can be like 50/40/10 or some shit.

Who in their right mind would do that? Just trade without me and keep more! Right!

Yes you could.

What I offer is personalized coaching. Not side line coaching where we talk once per month, or at the end of the day after you fucked up from being impatient.

No – I’m with you the entire session, narrating, talking you through my trades, holding you accountable, being a risk manager pulling you away when I see impatience. I also offer mind altering hypnosis sessions, where I brain wash you into the trader you must become. This is actually the topic of today’s discussion. However a lot of my Chronik blogs are sort of fractured between X and TradeCraft.

I need to document this and put it all in one place which will be here, under the proper diaries category.

I love to write, and my written content is more technically dense and better than video format. So I need my blog space to organize some of the gems I conjure up.

Chronik and I have been working together for a year. I have one student and that’s it. He’s paid me nothing. See, if I was to coach it would be $200 per hour. Now your performance doesn’t matter to me (although I will try my best) as you paid me for my time. I think one coaching session is not enough to effectively pivot most traders. They need full time coaching through the session. Back in the pit days this is how it was done. Some guy mentored you in the thick of it.

Anyways, this is why the split is high. If you perform I get paid. So if I perform, you will perform better. I want to get paid so therefore I will perform at a higher level when it’s set up like this. Plus, I have no desire to coach random people. 10 guys with 10 problems and a bunch of nonsense I need to keep up with. Fuck that. Coaching per hour just is not going to be effective as being in the thick of it.

Plus trading absolutely can be a team sport. Chronik and I are constantly communicating on the hard right edge. Someone else who trades like you confirming direction or some technique is a super signal in itself. I’ll be stalking a long, which happened today, and I was solid on my pulse checks. I had good reads on the market and so did Chronik. I get in this long and right as I do he says he’s going long a second later on the same price. Now I didn’t tell him I was in just yet. I’m quiet right as I finesse in. I need concentration. Also I don’t tell him right as soon as I execute. I’ll tell him once I’m in or when I just exited. I need him to make his own decisions, not copy trade.

When guys tilt it’s also very difficult for them to will power their way out. It takes extortionary discipline to do this which most of us don’t have. Having coach tap you out before you start going on a death spiral absolutely can save accounts and roll your equity up.

Plus on the tap out we take the time to get you in a trance and reprogram the subconscious so you can unconsciously develop that discipline.

This is team trading. It’s beyond what you know and think of when I say prop firm. It’s the way I think it should be. Men respect leaders who lead from the front. I’m lobbing grenades right next to you. Sometimes I start to fuck up and you’ll see it and learn from it. I understand exactly what you are experiencing and when it’s full time coaching with a small team, I get to know you. I can tell when Chronik is going to start fucking up before he does. I can stop it. This is something I will talk about more.

Look, there’s a lot of potential out there, but they need this environment to cultivate and nurture their talent. It’s hard to do this for yourself. I take a huge chunk off the traders plate.

Chronik and I have been working together for just about a year. He almost passed a combine and came to me. Really he cut in a queue in front of other traders I was going to work with. He had been doing a lot of journaling which was something I required at the time. If a trader can just do the work, review, tag, journal then that’s half the battle. I need that consistency. After all elite traders put in the work.

So I’m like shit, I’d like to get paid, let me get him through this.

Let’s put it this way: He had got lucky and trading relatively recklessly to get the combine to an almost passed status. Traders often can pass a combine to get funding and blow out. However, thinking you got a live account and maybe one withdrawal gets to you like you’re good or some shit. But you got lucky and are not that good. Why? Well, virtually none of you review, journal, and tag. And if you do, fewer of you study the material, and implement specific solutions to fix your specific problems. You have no statistics on how well your specific techniques are. Therefore you are confused, and unclear about what actually fucking works.

See, you might have edge but without statistics you wont know if bad management is the issue, or psychology, or maybe what you do just sucks. Pretty important to know the difference. I can tell you exactly where my edge is and what I need to know. I know exactly the chain of events that cause me to fuck up. It’s all stats. I then have a plan around amplifying what works, and neutralizing the bad. This is how you eventually extract profits.

Most traders are lazy and this job seems great at first glance. I don’t need a degree and I can just sit on the PC with my dick in my hand and print millions. No barrier to entry. It also looks like fast easy money. Lazy people and gamblers in denial get in this. Just because you make the trading decision and you have technicals doesn’t mean you aren’t gambling. You have no positive expected value until you have stats telling you and no… PNL is not a good stat. What’s the setup? what’s the read? What’s the technique? What are the stats on these?

Pro athletes review the games. Do you? Probably not.

Trader work is the difference, period. I’ve seen it work time and time again. Plus it’s just plain fucking logic. If you know where you perform statistically you have clarity.

Now, Chronik started to do worse when I came around. However what he achieved was remarkable. He kept his one account for 6 months. No resets. One account. Most of you churn these out in weeks. Fuck it, reset I got a free one – right? 😂 – in fact I had a developer land in my lap at the same exact time.

You ever wonder why casinos give you free drinks or a free night in the hotel?

Chronik truly had no real structure in the way he was making trading decisions. He struggled from severe FOMO on sudden down moves. He always had to catch that knife. Mentally he was no good. His focus was pure A.D.D.

Let’s pivot for a moment. Hypnosis. Why is this a big deal?

We live in a world where we are heavily influenced by our surroundings, the way we were raised, music, X posts, movies.

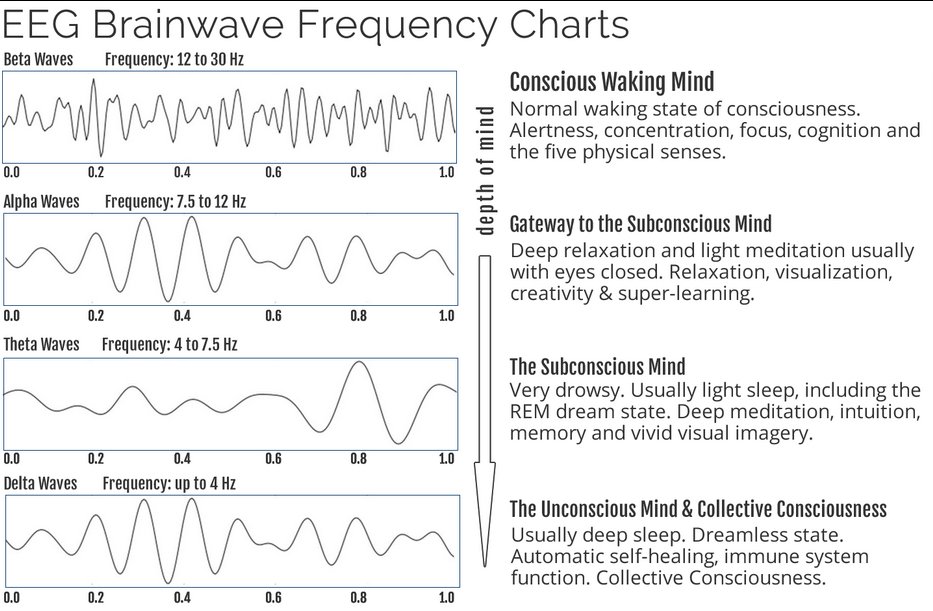

Kids are the most easy to mold as their brain vibrate in theta waves. Our brains vibrate in many different wave forms look below at the image:

You ever wonder why kids can pick up different languages so fast? Or why when kids are started off in sports of some sore they excel as adults?

As we become older past the age of 7, our brain develops and we start to have faster brain wave states. We tend to have more of an ego. More set in our ways. Children are remarkable in the sense they don’t hold grudges, and live in the moment. Plus your parents most definitely imprint on you, and this is because of your slower brain wave state. You’re in this trance like state, thus what you experience shapes your unconscious mind. There are neural pathways in the brain which form. These neural pathways are why you are the way you are. They can be altered as the brain is plastic. You can change neural pathways as an adjust through repetition, or even faster through repetition in the unconscious state. Going into trance forces slower brain states mimicking that childhood state, allowing you to rewire the brain.

You can actually do this now.

When you mindlessly doom scroll, you’re in a trance at times. Especially when it’s just short videos or some mindless shit of a guy power washing a drive way. ASMR is essentially hypnosis. People enjoy this state. It’s like meditation. When you meditate it just feels like a nice reset button. No thinking, just existing. Thinking all the time causes fatigue. Plus that shit can bottle up and create anxiety which creates depression.

Humans have not evolved to be able to handle this much technology. Technology came fast and not that long ago, so we are the first to really go through it. It over stimulates our brains which has negative effects. As you zone out, aka go into trance which is what hypnosis is – you are most likely filling your subconscious mind with garbage and nonsense.

Fashion and trends are the way they are for a reason: We are exposed to it through repetition, and if we relax and let that content in, it rewires are brains to the point what ever it is we are consuming is what we “become”.

Humans are easily influenced. I do it through my content. Now some of you don’t buy into me, but odds are you bought into some system or way of thinking, whether it was your parents, or trauma, or just content you overindulge in like trolling or interacting in hostile ways.

See, we as humans can’t handle being bored these days. You have a pocket computer to stimulate you at all times. Every where you go, everyone is nose deep in their phones looking at most likely nonsense. When people get bored they either become sadistic to others, or they just scroll. The alternate method is to just sit with the thoughts, and use no content, or music to take you away. But that’s uncomfortable. This is why meditation is tough for most.

Hypnosis is simply a trance like state I put you in. I talk slow and deep like Morgan Freeman. People like Freeman’s voice because it induces trance like states as it’s relaxing when he drones on about something. Binaural beats, and nature sounds also help. It’s basically ASMR.

This is where I use techniques to create hypnotic suggestions to rewire your subconscious mind.

My theory is I can brain wash people into becoming elite traders.

Psychology, is a problem for 99.999999999% of retail traders. I’ve talked to a lot of traders. I know retail traders. A lot of you are similar. Myself included. I am cut from the same cloth, however I’ve taken it upon myself to brain wash myself into performance, and I swear by it. But can my snake oil help others?

Hypnosis is a scientifically proven method backed by plenty of studies. So as far as I’m concerned it’s not snake oil.

This is where my 50% split comes in. I bring custom tailored solutions to your problems. When I do a hypnosis session I go into the trance myself. I become you. I pour my heart and soul into it. It’s never scripted either. It’s a journey.

As I channel myself into this altered dimension, someone like Chronik starts to vibe with it. After all, the universe is vibrational. We vibe with content, and certain people as humans. Why? Why is that word used to describe it? You might be vibing with me right now?

See, I create relatable scenarios and stories. These things are hypnotic techniques. In fact you may have performed it yourself on others?

The intensity of my sessions creates emotions and feelings. Emotions and feelings are key to rewiring the brain.

-Note- I am picking this up and writing a few days later. When I write I go into a headspace and flow. So the cadence will now shift.

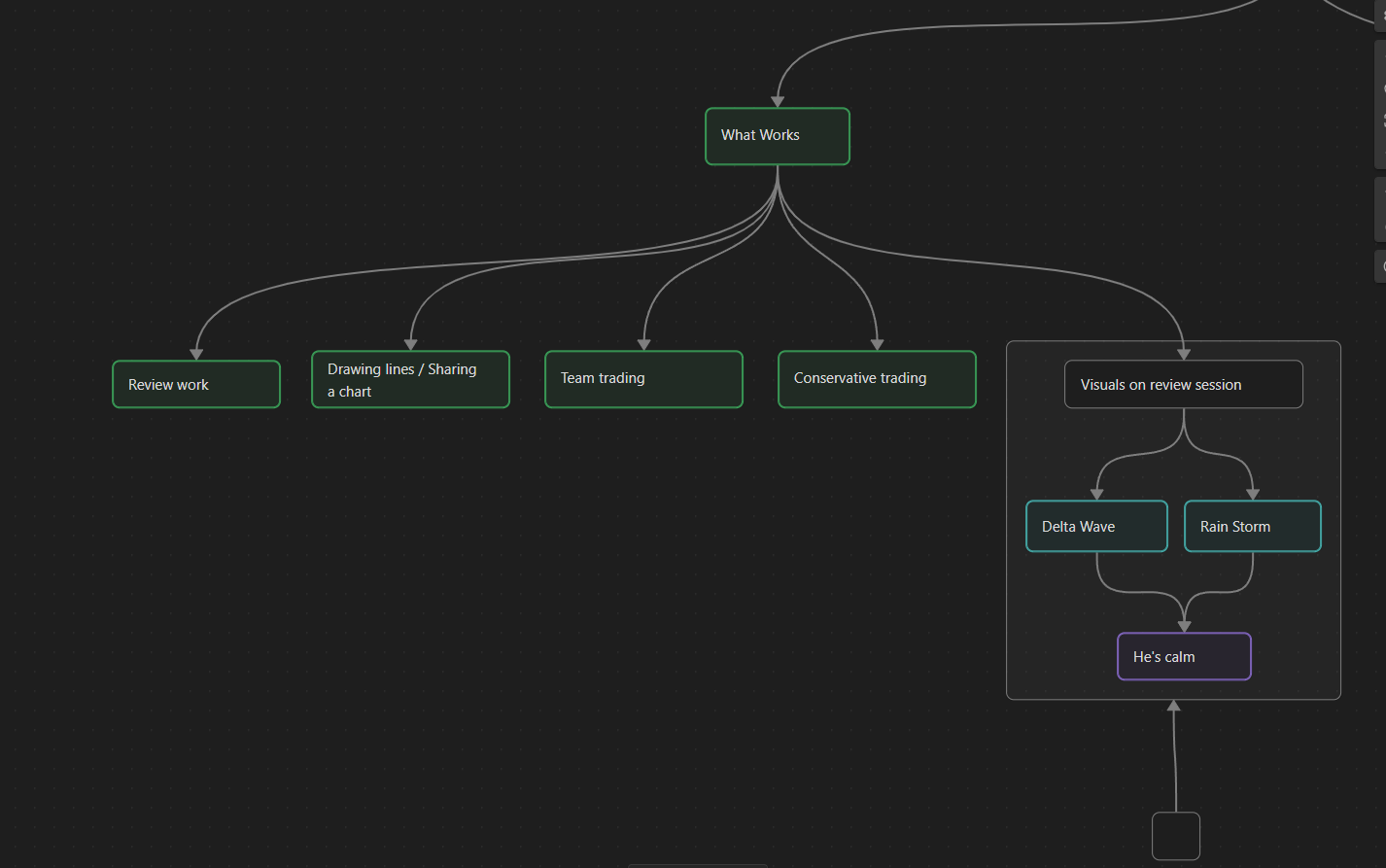

Chronik and I needed to identify issues. I started creating a flow chart around his issues.

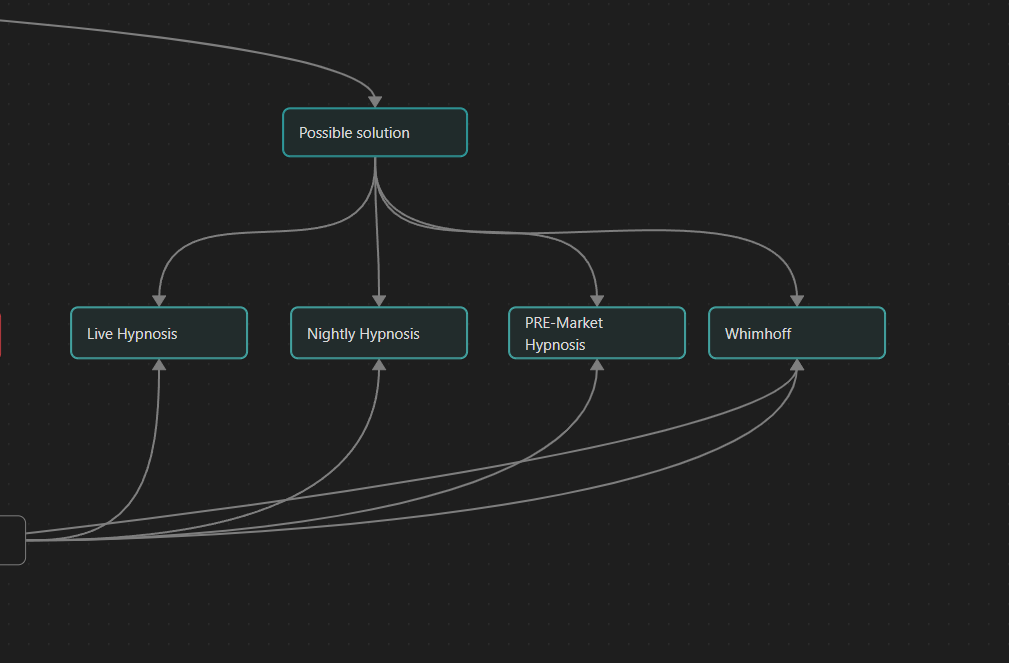

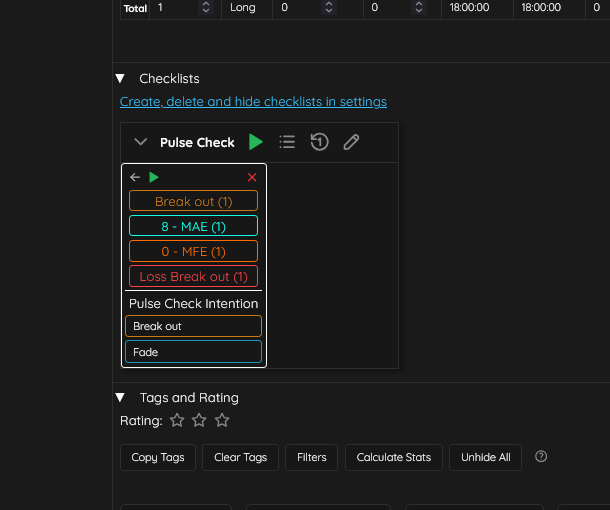

As you can see, these are a few things that we know worked for him as I started to experiment with Chronik. There’s also this possible solutions category where hypnosis resides. I can safely says Live Hypnosis sessions work.

Chronik had trouble with catching knives. He just reacted impulsively to sharp down moves. He created this habit from trading some other products. I implemented a hypnosis session and the issue went away after one session.

Another issue he struggled with was he had split ways of viewing himself. Half of him wanted to be a higher performer and the other half wanted to be a bum. I ended up doing some quantum time line therapy which is more NLP than anything, but lacing in hypnosis with a trance state. We ended up going through his earliest memories to find fear, shame, guilt. Stuff like that. It took several hours to do this.

I go through this process because, a trader has some issues that clearly came well before they started trading, but carry it into trading. In fact we all do. So it’s pretty important to clear this shit out. Or rip the roots out.

If I do my part right the trader has a deep emotional experience. Why is this?

Adults are creatures of habits. In order to truly change, we must experience things like trauma or other intense emotions impacts. Trauma can be relatable. Maybe someone you loves died suddenly. You immediately carry a different perspective on life.

The emotional impact of that experience was so intense it shifted you. Sometimes this can be done with psychedelics like mushrooms. This can be part of why psychedelics are being used more and more in therapy sessions. Trips can create intense emotional experiences that forever alter our realities.

My goal is to evoke this in some NLP session, like quantum time line therapy and parts integration.

Often, when we feel conflicted about 2 different things, our subconscious mind really wants the same thing. Parts integration allows us to bring these two things together. It’s pretty fucking intense emotionally if done right.

After these 2 back-to-back sessions, Chronik changed immediately. Parts integration was so intense that after the session, he needed several hours to himself. He felt good. He felt like he met a best friend he hasn’t seen in a while.

Chronik had more pep in his step. I could tell on a session-to-session basis. However issues still came in. We didn’t have a miracle cure here. His focused wavered and he would experience contentment issues with losing PNL. If his focus went, he would mindlessly trade. Losing and attempting to fix trades with more bad trades.

In the early days, I’d let him trade unsupervised and his trading tended to go to shit. We had narrated a lot together, which kept him in check. This is why team trading is the green “what works” section above in the photo. I had started to build a flow chart on what was working and what was not. However there came a point where he simply had no edge.

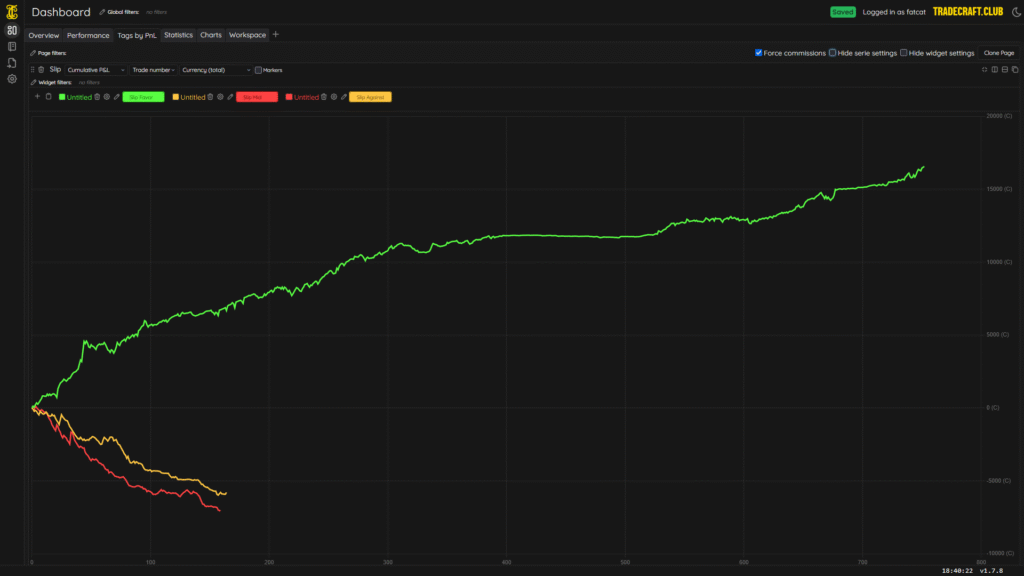

At the time, I had another coach assisting me. We had daily meetings on Chronik to see where his strengths and weaknesses were. Edge came up time and time again. Chronik’s ability to trade successfully was slipping away. Just chipping away at his account. So I decided to bench him. I put him into a drill for a month. Slips. He needed to trade just into reclaims and slip zones. Statistically, at this time and to this day that entry technique has edge. Now, doing this without contextual reads is by no means profitable on it’s own. But as a scalper it most of the time gave you immediate momentum where the trade was up right away.

Above is his TradeCraft statistics on slip entries.

By drilling this technique for a month he internalized it. To this day, anytime he trades he says “I need to get a slip favor” – it has become an unconscious habit at this time, which is good. We want to take good techniques and habits and make them unconscious. Most of what we do on the day to day is from an unconscious place.

Now, let’s pivot into contentment issues.

I remember in February or March of 2025, we had VIX spike into 50. Volatility was fucking high. We had been in a low vol environment for some time. I know Chronik never traded this new face melter price action. He was on 1 lot mini and I put him on a 1 lot micro. He fucking hated it. The issue was with the higher vol we needed to size down, trades were naturally going to blow you out 5 points in seconds, whereas in a low vol environment, 5 points is a home run and you may get blown at worse 8 ticks. I needed him to trade looser. Bigger stops, but in order to compensate the wins needed to be larger.

Price action is like a rubber band. It’s the same PA, but it just stretches and expands. You have to adjust targets and loss based off that. Otherwise if the targets are too small, you’ll be taking on losses you cant fix. If the stops are too tight, you’ll be getting hit a lot paper cutting your account to death.

What was a win for him was he survived the entire regime shift. He even had some really solid winning days. Now at this time I was still attempting to figure out how to make him consistent. After all, there’s no hand book on coaching traders successfully.

I started making mistakes. Letting him trade by himself was one. He needed full accountability. At the time I also struggled with waking up. I traded mid-day a lot. It wasn’t until some time later that volatility got so bad I had to trade opens. I also was having more and more pre-market meetings to figure out how to improve TradeCraft or fix some bugs, seeing how the dev lived on the other side of the world and needed to sleep when the afternoon rolled in.

Lets talk about TradeCraft for a moment. I had no intention of building the platform. I was attempting my coaching run and this prop thing before software became a thing. I knew how important trade tagging was for me. I had preached it for years on my YouTube channel. I have an older coaching playlist where I was coaching someone named Slimtrady. There’s an episode where we went over tags. Tags got me consistent and I also needed data on my traders otherwise how the fuck do I know what’s working and what’s not, much like the slip favor stat I shared in the last screen shot from Chronik’s journal.

I had my traders – which there were multiple at the time – tagging in spread sheets, and it was simply not cutting it. I needed more control and a better way to filter through the millions of combinations of different tags.

I tried to get another journal provider to partner with me, and asked them if they could allow Sierra Chart to work with their journal and they refused. So between the combination of the pain in the ass use of spread sheets and not having a decent journal led me to develop TradeCraft – in fact I had a developer land in my lap at the same exact time. Funny how things tend to unfold….

TradeCraft was intended to be used for my prop traders but as we were building it other people wanted it. So it just made sense to make it commercial.

Now if you are unfamiliar with tags, this video is A-Z about what they are and how to find edge.

There are a few key things every trader needs to do.

- Record the session

- Review the recording

- Tag the trades

- Journal their thoughts

- Mark up screen shots

- Review tags over time

- Review thoughts over time

- Review A+ trades

This foundational work improves a trader over time. A trader doing this will improve faster. I’ve talked to traders who did this process and can vouch for it. It works for me and I see improvement with Chronik.

This work however can suck. This is where another hypnosis session came in. Chronik would put off his review work for days. He would do it but not in the moment. We both knew it needed to be done daily. Funny thing is I had been learning about Erickson style of hypnosis. Basically you ramble on about nonsense switching the subject often creating confusion while slipping in hypnotic suggestions. I did this to Chronik and it fucking worked the first time. He immediately started doing his review work the day of. Occasionally he misses a day but it’s rare.

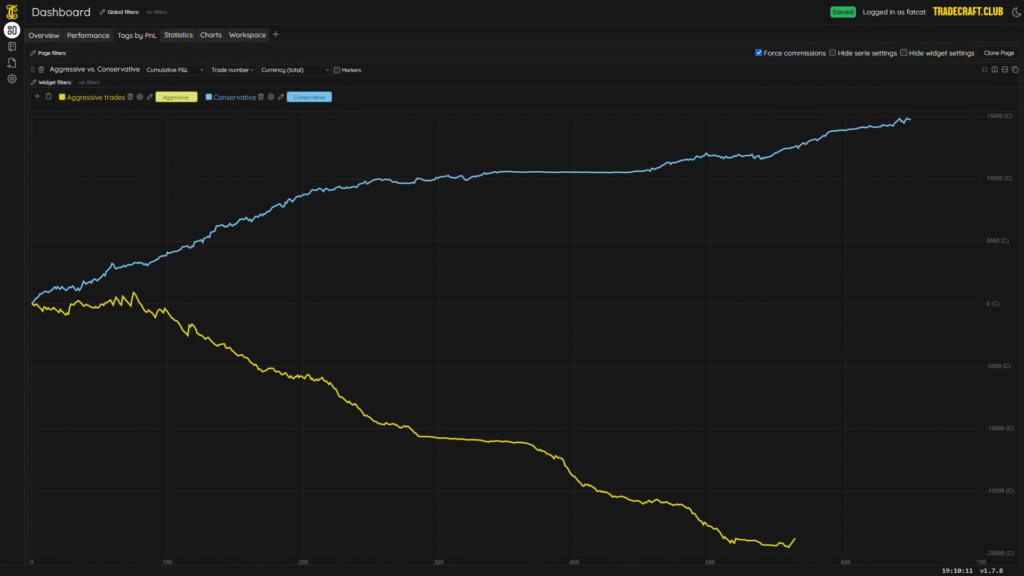

Another thing that statistically worked for him was conservative trading.

As you can see above on his TradeCraft platform, he obviously performs here.

Conservative trading is basically scalping and aggressive is holding.

Scalping just works for him so this got lumped into his list of things that work.

Hypnosis sessions to keep him in the scalper mindset started to get employed, now there are some issues that started to come up.

Earlier I established he needed to trade with me. We started making it a rule that he couldn’t do it without me. Here’s an issue: If I can’t read the market or if I got frustrated it would affect him. I almost became a conduit where my abilities could transfer to him or my frustrations or confusion.

As the year went on, I noticed I would take on losses right at the beginning of the day, then I would fix the issues. This happened a few times per week. I really didn’t enjoy getting into these holes to dig out of, but I was good at the digging out part. I started to wonder if there was a way to prevent the holes to begin with.

There is a method. Let me explain: Market regimes are different day to day. Sometimes they can be similar but the price action is always unique. A trader’s finesse of methods may need to be altered from one session to the next. Just because breakouts of areas worked the prior day doesn’t mean that’s today. The session may require fading. The trader needs to warm up and gain clarity. Basically take mental trades and see if they are right or wrong, and by how many ticks they’re right and wrong. This allows the trader to know what they can average on profits for the day. Maybe I want to average 8 tick wins but the day only offers 4. We need to know that. I take these mental trades. I make sure I could get the fill if doing a limit. If I can get 3 tests or pulse check trades right, I have a solid read on the market especially if the checks are in a shorter duration. If they’re wrong, I’m confused and have no read.

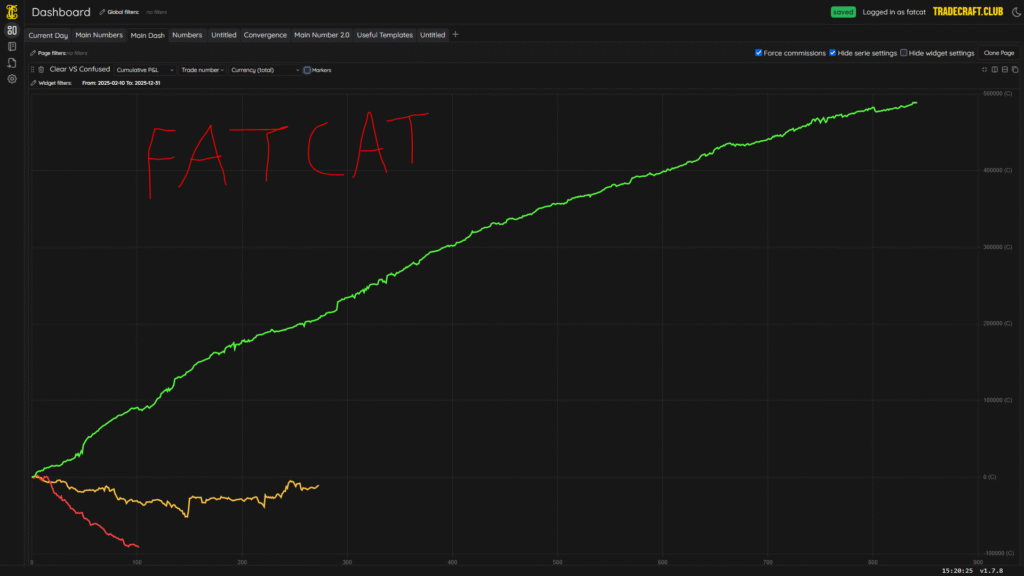

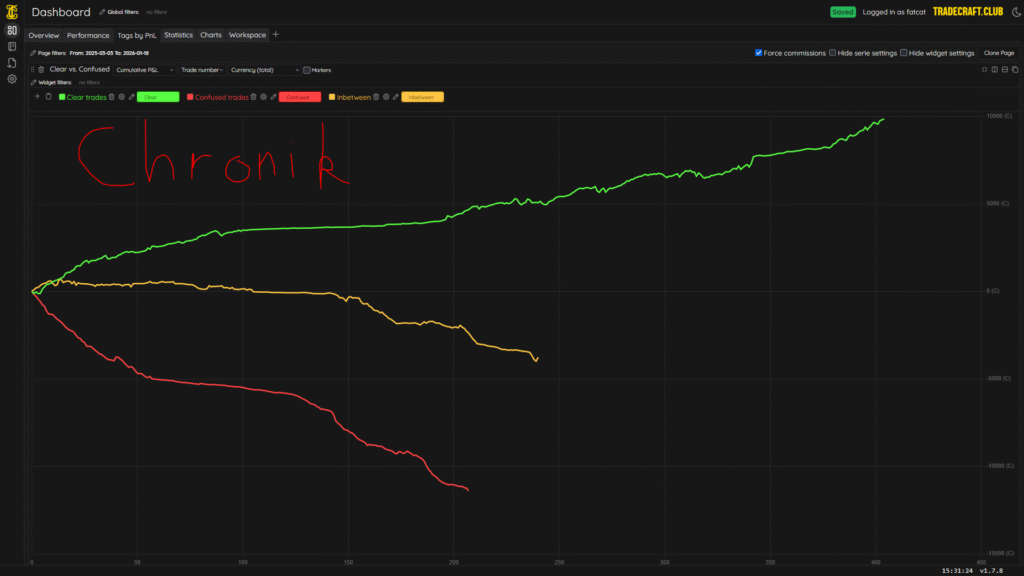

Clarity is edge. Here is a tag Chronik and I track. It’s our clarity vs confused tags. The yellow one is when we’re on the cusp of clarity but still unsure.

Notice how I have more clarity tags than Chronik. Also notice how our curves look the same. Green clarity performs, yellow mid clarity is in the middle and pure confusion is the worst. Between myself and 5 other traders that used this stat, the same order or performance in shown. However, more confused or mid-confusion trades eat the raw equity curve, therefore taking trades from a place of pure clarity is important.

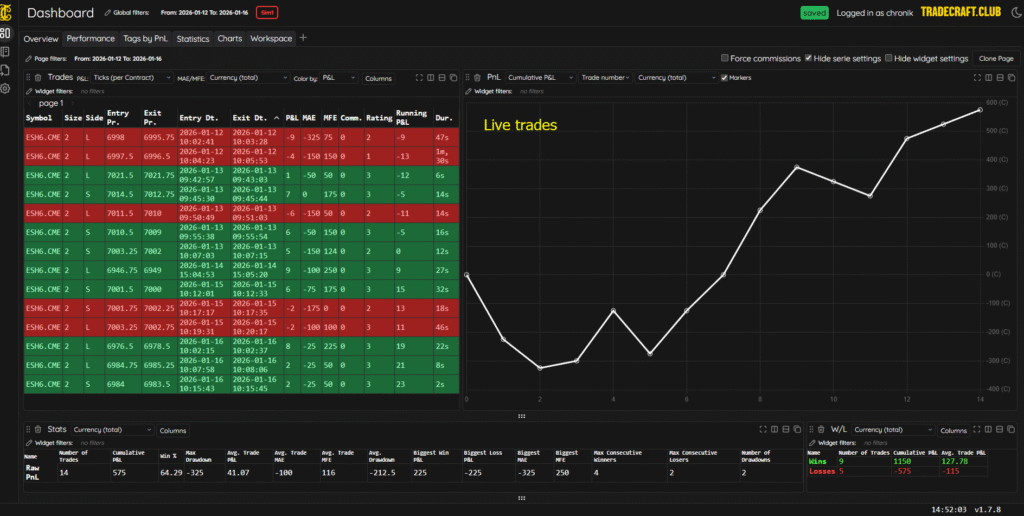

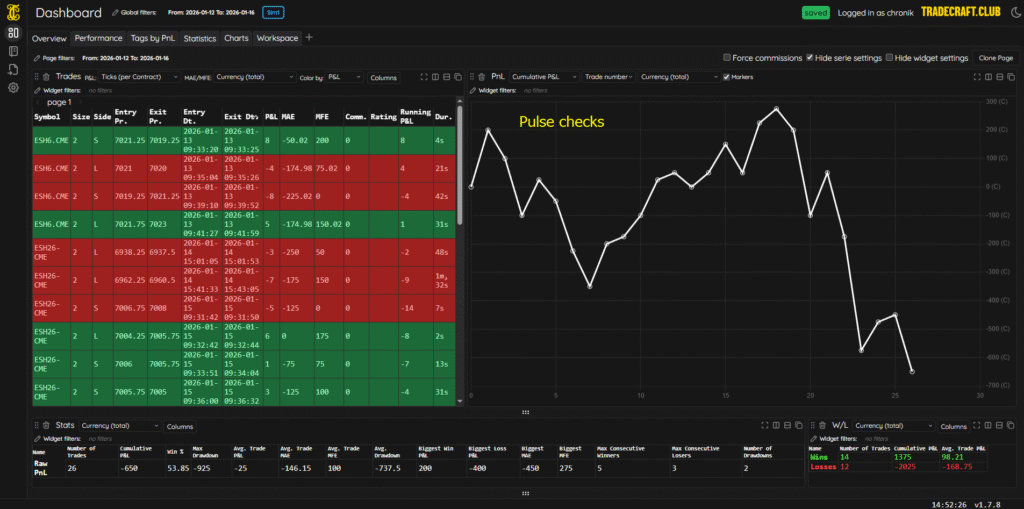

Most trades taken at the beginning of a session are from a place of confusion if you start to lose. The reason is you don’t understand the day’s regime. Getting the pulse checks in or taking a few sim trades can allow you to dial in your ability to become clear. For example, Chronik has been taking physical sims that don’t affect is combine on the open.

Below we can see this:

Chronik is taking the pulse checks before he trades the account that matters, notice the performance dips. He’s feeling how the regime is through this method. Then we switch to the account that matters and we can see there’s actual performance.

This method of pulse checking can also be achieved through check listing, which is what I do.

Above, we can see I took a breakout check and it went against me 8 ticks and it didn’t work for me at all, as the MFE is 0. So it’s a loss and the checklist counts the losses and wins. I can now start the process over and attempt a fade. This lets me dial in how I need to finesse the session.

The checklist is built into TradeCraft and it’s a fantastic way to boost clarity or build trading systems in general.

Let’s talk about why or how traders blow out a session. We’ve established clarity as being very important. When a session first starts, traders either do well. Which they’re clear on the session. Or they are not clear. What happens is a trader is confused and starts to become impatient. They take a trade outside of regime clarity. Sometimes they’re lucky. So they take another trade and lose. This creates lack of contentment in the PNL. Traders tend to hyper focus PNL as the end all be all of how well they’re performing. They want to immediately fix this loss. They take another trade and another loss. This creates tilt. Tilt and lack of contentment with impatience on top and complete confusion on market regime ends up with the famous spiral of doom. Traders add to open losers by dollar cost averaging. They start revenge trading. They sit in the session too long and performance fatigue kicks in. When they’re stressed the body starts using more nutrients which prevents the hungry brain from being able to operate at full capacity.

Confused -> Impatient -> Loss -> Not happy with PNL -> Still confused -> revenge trade -> loss -> tilt -> not happy with PNL -> impatient -> loss -> blow out.

Now at any point in this kill chain a trader can gain clarity. This can break up the chain and allow a trader to savage a day. However, you’ll have whippy equity curves because of this.

If Chronik starts to slip on focus or goes from clarity to confusion which does happen in sessions. You never go confused to clarity and maintain. The windows of clarity do close up. Some are longer than others. When Chronik does this, I can tell. So what I do is pattern interrupt his kill chain. If he takes 2 losses in a row, we stop and review them immediately in the recorded footage. I then will induce hypnosis to set the lesson or adjustment into his subconscious in the moment. The fresher your trades – the sooner hypnosis is induced, the more powerful it is. Sometimes he doesn’t take losses and we just do the hypnosis because I can hear him throwing bad narratives out. This pattern interrupt with a combination of review work and hypnosis is very good at preventing unnecessary loss. Sometimes the methods vary. I’ll have him do Whim Hoff breaths if his heart rate increases, as he has a heart rate monitor on during the sessions. Whim Hoff is essentially hyperventilating, which forces delta brain waves allowing me to do almost these rapid fire hypnosis sessions that aren’t 20 minutes long.

Remember when I mentioned my sessions would start off down a handful of times per week? This very thing I mentioned with the kill chain above was happening and I would pattern interrupt by gaining clarity to bounce the session back. When I would slip up or had confusion, often times this would affect Chronik. Part of his ability to trade well is me feeding him narratives as the market panned out. See, we get sucked into the screens and pattern interrupt gets almost impossible at times. So if it’s happening to me, Chronik rarely knows when to pull me out. I have no accountability. I needed to prevent this from happening. So I made a decision that the beginning of 2026 is to put Chronik first. I wait for full clarity while not trading, thus preventing me from getting sucked in. I make sure we both have clarity and I do pulse checks with him. We get the regime dialed in and start to unleash at the same time. I needed my communication to be always there and the same for him. I force myself and him to always be calling shit. Even if it’s nothing. Where’s the levels we want? What’s the order flow up to? The more we talk, the more we both spot shit the other guy misses, boosting awareness. The constant talking helps us identify when confusion is coming in. This is what makes this become a team effort. Because Chronik is becoming better in a lot of ways, it helps me trade better as I got someone calling shots and seeing things I might forget.

Let’s talk about narratives.

Narratives are a skill in their own right. Something that requires a lot of experience to do well. As a trader narrates and narrates well, this also paints clarity. This is something Chronik just needs to experience on the hard right edge day after day, regime after regime. I can’t do hypnosis to build this skill set. Now there are methods to help maximize the day. This would be the review work.

Watching the recording of your trades helps you see if you missed a critical pattern or if you just fucked up. It also let’s you see the good. Screen shotting and labeling what you saw to make a trade decision or what you need to correct helps you absorb the lesson. Most traders won’t do this, thus they never really know what adjustments they need to make. Often times in our reviews, the adjustments are pretty straightforward and simple. Sometimes it’s hard to figure out what went wrong, but as you trade more you start to figure out exactly what worked and what didn’t and more importantly why. I personally rarely have back to back losing days. I hadn’t had one last year in 2025. It’s because I double down on losing days and learn the adjustment, which I carry into the next session. Remember the kill chain? The kill chain can carry on to another session on the next day if the review process isn’t done. The trader starts off the session immediately upset about yesterdays PNL and picks up the kill chain where they left off in the prior session. This is why I mentioned earlier we will review mid session if 2 losses in a row come in.

Since every trade is unique, another method to maximize the review is Whim Hoff breath for 30 seconds and I start feeding the adjustments the trade needed to make as if they made them already on the setup while they look at the screen shot. They’re in a delta wave state and since every trade is unique, we internalize them further through this method.

Now let’s pivot. Chronik had blown out his 6-month account without me one day trading 2 lot minis when he was to be on 1 lot micro, as his account was nearing draw down. I made him sit out for a full calendar quarter with no coaching. This had led me to reevaluate the process of how to coach him. See what worked and what doesn’t. Chronik makes his own trading decisions but he needs to lean on me a bit for clarity on narration since I just have nearly a decade of experience there.

Another issue was my trading was evolving a lot over the year, as I found a ton of edge in order flow. I had been adjusting ways to read it, trying to dial it in. The charting screens and levels or ways to read narrative would shift on him at times which caused confusion. However, as of 2026, we have discovered an ace up our sleeves that really has boosted our ability to just extract raw edge from the technicals. Now I’m not sharing the secret sauce. It’s in my narration and report card sessions in my course section. It’s not even in the modules yet, as we need more time before it becomes a module. So watching me trade on the day to day is how you can see this thing unfold. The narrations are for sale here.

Typically when pro teams in sports has a coach turn over before they go on some legacy run, they don’t do well the first year or two. Just because Chronik has not hit consistency or received a payout doesn’t mean he hasn’t improved. Improvement comes first, then the PNL starts to fruit. This last week of trading, which at the time of writing is 1/12/26 – 1/16/26, has been his smoothest yet. A combination of better coaching on my behalf as I’m learning too, and edge refinement is just contributing to his performance. After all, this has been a charity for me at this point not receiving a penny form Chronik. However, once he gets paid, I get paid. So hopefully you can see why it’s a 50-50 split and how much I bring to the table for a trader. This is not like any prop online. This is beyond what you guys know as prop.

If you found value in this post as it took 3 days to write, feel free to tip in proportion to the value you received here.

After all, it’s through your support that I keep making unique content like this.