Flow State

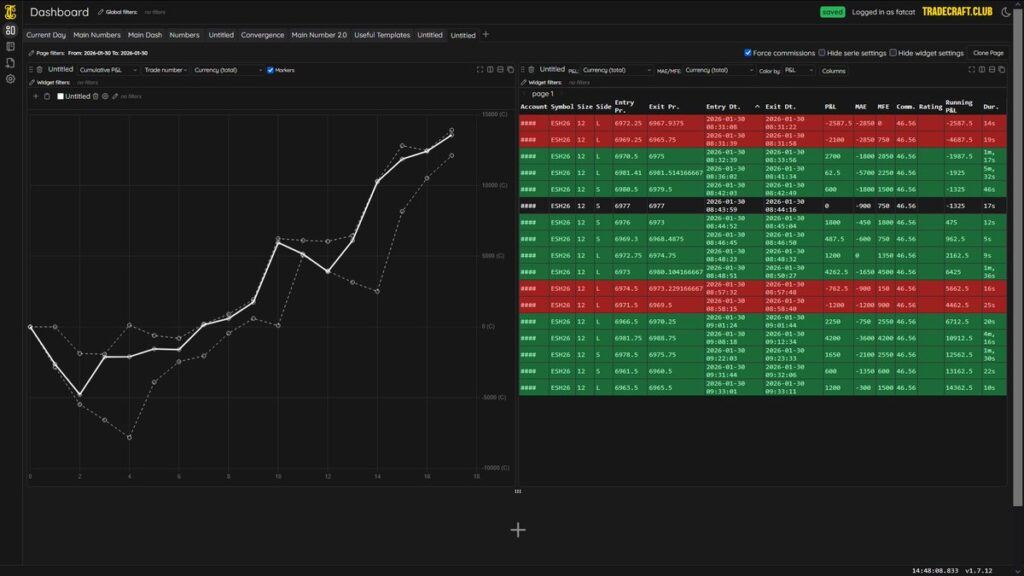

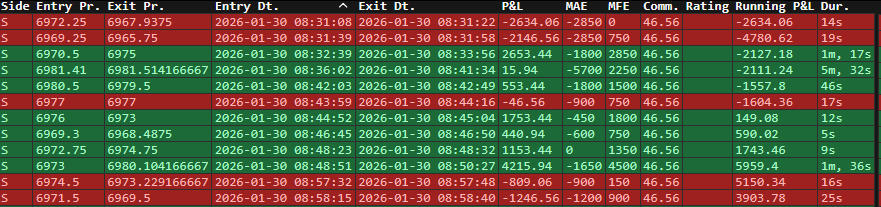

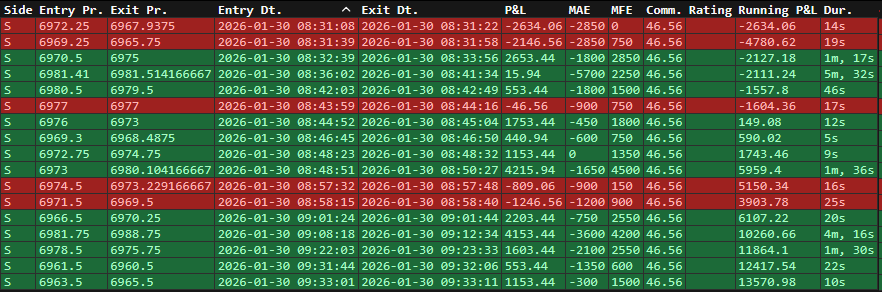

Friday was a 13K day. The biggest of the year so far:

There were other traders sitting around when I did this and it’s funny how you get congratulations, and praise for this type of performance. DMs started rolling in. You become a legend for the day. It happens to every trader that hits big. People respond to that.

My ability to read the session was un-fucking believable. I became a prophet, predicting the future, one rotation after the next. Obviously we started in the hole, but my confidence was sky high just like the volatility.

It’s like an athlete. They’re often just remembered for the last game. If they crush it, they’re praised. If they fuck it the hive minds doubt creeps in.

Often times things get worse before they get better. See what I showed you was Fridays performance on my TradeCraft dashboard. What we need to do is go back in time and look at the rest of the month.

Notice how the curve is flat with a slope up than another longer period of flat before Friday.

Clearly there was a struggle. So in order to understand phenomenal performance we need to understand what happened before then.

Earlier in the month, I had spent over a week running numbers and looking at data on all of my trade tags in my TradeCraft platform. I did a video on those results, now keep in mind the first part of the video is a tutorial on tags: https://youtu.be/DDMIdAXUBVI?si=tsyDAUychloPzj0G

There was specific tag that had a ridiculous win rate. I had retired it but noticed in a lot of screen shots of my A+ scalps I was talking about this setup. It’s a volume play that has specific parameters in the volume and matched with a price action setup called a reclaim. I mention reclaims all the time. If you’re unfamiliar dig through my YouTube channel, you’ll find the video explaining slips and reclaims.

Now this tagging video was an absolute flop. People don’t want to watch the shit that matters. Reason being is the industry is mostly comprised of newer traders and that shit is too sophisticated. They’re main focus is chasing a setup or system. Or gambling….

I prefer writing and I think the demographics of people who prefer technically dense info are going to be in the reader category. But then again there’s plenty of retards who can’t read this far and feel the need to let me know they will not read this. Thank you for your useless comment. God knows the internet is already overflowing with useless comments and other brain rot.

I know I’m on a tangent here, but the shit we consume shapes our reality and influences us. X is pretty much a dumpster. It’s so bad that I have a tab that takes me straight to my own page, so I don’t have to see anything that will suck me in to the point I’m watching some people fight at McDonald’s, or some very convincing AI propaganda that looks real as fuck. I come here to post, and I don’t look at anything else. Well, sometimes I sneak a peak. But in between posts I’m not here. I can read the comments from the prior post when I’m ready to make a new post.

When I grew up on the internet we had forums. While they were filled with egos it seemed to be more technical back then. So was the trading content on YouTube. When you get older you just reminisce about how shit use to be better.

I digress. When I’m dead and gone hopefully my writings and documentations can be carried on by the next generation. This is why I’m storing all this on my blog. I guess when I’m dead and gone the web URL won’t be paid for so maybe all this shit disappears? Fuck….

My name is Fat Cat and I have ADD

I promise there’s a stroke of genius in between it all.

So I have this tag called the “Double R” and my god it worked too well. So I decided it was worth pursing through out the month and it didn’t go so well.

Anytime we take on something we’re not use to, we suck at it. Kind of like learning a new skateboard trick. We’re not good at it until we get some time practicing it.

So I floundered. Confusion and bad trades were certainly laced into the month. I also struggled in December as well. Trading just felt harder. I don’t think that cycle will ever stop. I trade really fucking good for these extended periods of time then Ill have a week or two of just struggle. But this time it has gone on far longer than any other period I can remember of recent years.

It’s like something changed. After Thanksgiving the market just felt different.

I have a few things I often cycle through:

- Multiple factors of support

- Multiple time frame analysis

- Correlations

I have always felt the order flow is off in ES. A few years back I made a video on this and people either agreed or thought I was fucking retarded.

The order flow in ES and even NQ do not feel like they come from their own order book. Obviously the stocks contribute to the movement, they’re indices after all. I’ve put in a lot of time looking at these products and stocks can do things that have zero influence on ES or NQ. Sometimes they stroke together on movement sometimes no relationship.

I don’t know what made me think of this but I felt the need to look at MES. I don’t ever look at it as far as order flow correlations go. I remember that it came out in 2019 as a new product, and after 2020 the liquidity in ES just fucking disappeared and NEVER CAME BACK. You’re talking an order book that’s 400 lots thick. Just gone. I was thinking that maybe some of these spoofs, or phantom movements were coming from MES seeing how it moves the exact same as ES.

MES and ES are obviously arbed from a price action standpoint. Same movement tick for tick. Yet the order flow is different. Not that the MES is less notional value than ES, But the actual buying and selling are different. Now it’s similar but there can be sessions which are rare where there’s more buying in ES and more selling overall in MES. It’s fucking hedging. The order flow is fractured in between the two products. So a spoof on ES can be an order flow event on MES but since I don’t look at MES it looks like pure manipulation where ES spoofs. The arb programs keep them trading the same price. After all, any drift will just open up more profit potential for arbitrage trading, and since arbitrage trading is so fast and so competitive the price is lock in step which prevents market makers from also getting their stale quotes from being picked off.

Cross market manipulation is a great way to trip up the CFTC who investigates manipulation in the futures market. Cross market manipulation allows you to post a large quote on one product and reload the other and do a traditional flip or spoof like Paul Rotter or Nav Sarao use to do. Cross market manipulation is just harder to track down, and a lot easier to do in a highly arbed environment that keeps products lock in step like MES and ES.

Now I’m by no means trying to find this shit in the order flow. I however realized I need to look at both.

It was amazing. MES influenced the shit out of ES. Part of what I do is track inventory imbalance. This for me is important as market makers are always trying to re-balance inventory. MES would imbalance and effect ES movement.

Getting the imbalances to align was working. I still had problems however. Now let’s not forget these re-balances have to do with that double R tag I mentioned earlier. Essentially the double R was taking advantage of offset inventory.

Now I decided to employ a secret weapon to help my reads. We were looking at MES and ES as well as a buffet of other shit. It needed to get consolidated so we could react faster plus looking at too much shit is hard for my prop trader Chronik.

The problem is there was a ton of math involved and in order to get my wonder weapon to work I had to figure out that math. I didn’t know what the right math was. I thought I did multiple times but then shit would just not make any logical sense when I thought about it. I would get these amazing signals with bad math at times. Like I was very certain FOMC 1/28/2026 would have a massive dump. Which it did near the close. But once I corrected the math the signal would go away. I was getting great reads on a broken weapon.

Chronik was nervous about me switching the math up but I was obsessing. It needed to be right. He was also getting good trades off our broken weapon so naturally he thought we should just roll with it.

Now if you’re unfamiliar with Chronik you should read this blog post as it will go over who he is.

What I was doing was not just improving my trading but Chronik was fucking crushing it as well.

After that FOMC session he had found something. He sent me all these screen shots and I spent the night replaying the session looking at this. It fucking worked and it worked well. Now this isn’t the Double R nor is it looking at MES with ES, although those two were contributing to how we were trading. It was an inefficiency. At least that’s how Chronik worded it.

Whatever this was worked really fucking good.

Thursday 01/29/2026 our secret weapon had been worked on. Now the secret weapon is not the setup Chronik found. We had a lot going on at this time. The setup is called the “boomerang”. The secret weapon was feeding us info. We had been chatting the night before and it was one of those to good to be true moments. We fucking lived that scenario so many times, but Chronik was beyond ecstatic. He has enough experience at this point to just know things. Things like smelling out edge like a fucking hound dog.

I never seen Chronik vibrate at such a high level like this. This was different.

Now, I had been obsessing over the weapon which we will call “paper clip” from now on. On the morning of the 29th, I had an update I needed to get dialed in for Chronik and I. He was itching to trade. His internet was having issues, and on top of that I needed him to run a long process to fix his version of paper clip. This was cutting into the morning session. He usually only trades one hour. We were 30 minutes in with no trades fucking about. He became incredibly impatient. I had to do breath work with him. I needed to pattern interrupt him and do some form of hypnosis to dial him back in. I’ve seen him get to this state and just fuck the session from over trading or being way to aggressive especially when he knows his session is going to end soon.

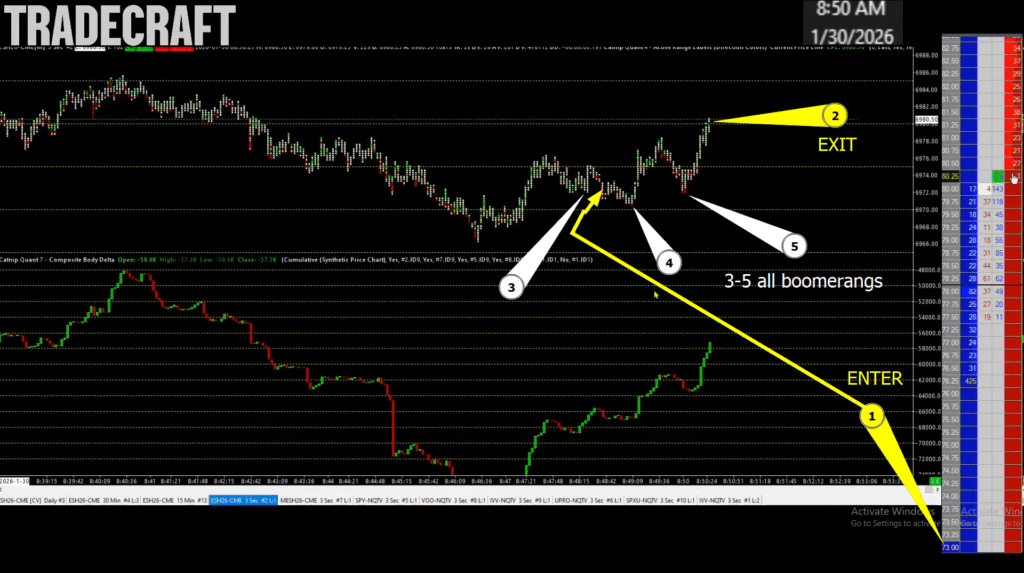

So I wrangle him in and now we trade. I end up taking two back to back wins with the boomerang closing out +$1,856.88 in profits. This was an easy session for me. I had a rough week of just battling. But now everything had came together.

Chronik was becoming more excited. He has never received money from trading as he is still trying to pass a combine. However I could tell he could taste it. I had to keep trying to calm his ass down. Remind him to not get to ecstatic over this. I felt like there was level of delusion setting in.

Part of his praise was my ability to pattern interrupt him very effectively. He loved that shit. Funny thing is I told him he’s going to hate me when I do is in the moment. But once the rational mind comes back online he gets it.

The big one

Friday morning rolls around. I had been doing silent meditations laying on my back on an acupuncture mat for the last 2 nights. I had also been going to bed early around 9 or 10 pm. I’ve had sleeping problems all my life. I can’t fall asleep even with no phone. I also need a lot of sleep to just feel well. Part of my problems earlier in the week was I had woke up early to coach, but I really didn’t want to be up. I traded like absolute shit. I decided to attempt to fix things. I always could fall asleep fast while laying on my back on the acupuncture mat with a hypnosis track. But I didn’t want a hypnosis track. I wanted just pure fucking silence. The sleep from Wednesday night to Friday night was phenomenal. I passed out fast and the meditation was super deep.

I wanted answers and often times when I go in these deeper meditations I can get direction for something I’m searching for in life. Now Wednesday night I didn’t find it. I kept getting a message to essentially come back. It’s like I find god in these meditations or something. There’s knowledge there.

So obviously I traded well that Thursday. So I’m like I’ll go to sleep at 9 and do it again. This time I passed out. I didn’t make it to the place of no thoughts where I’m in a trance where my mind is still awake. But I did get amazing sleep again. I woke up early and couldn’t go back to sleep. Usually I just roll in about 8am CST this time I was up at 6:30 am just feeling rejuvenated which was amazing!

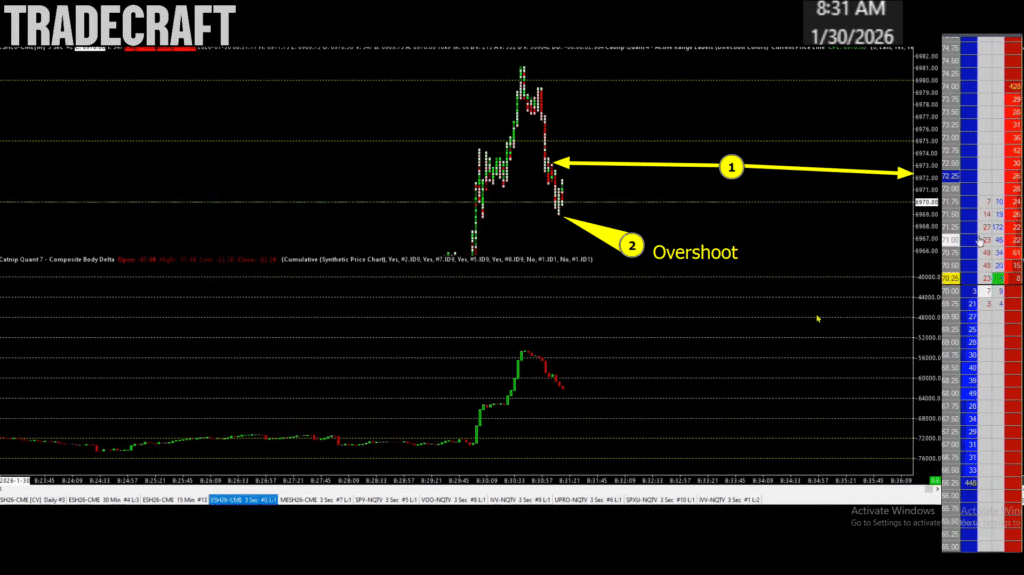

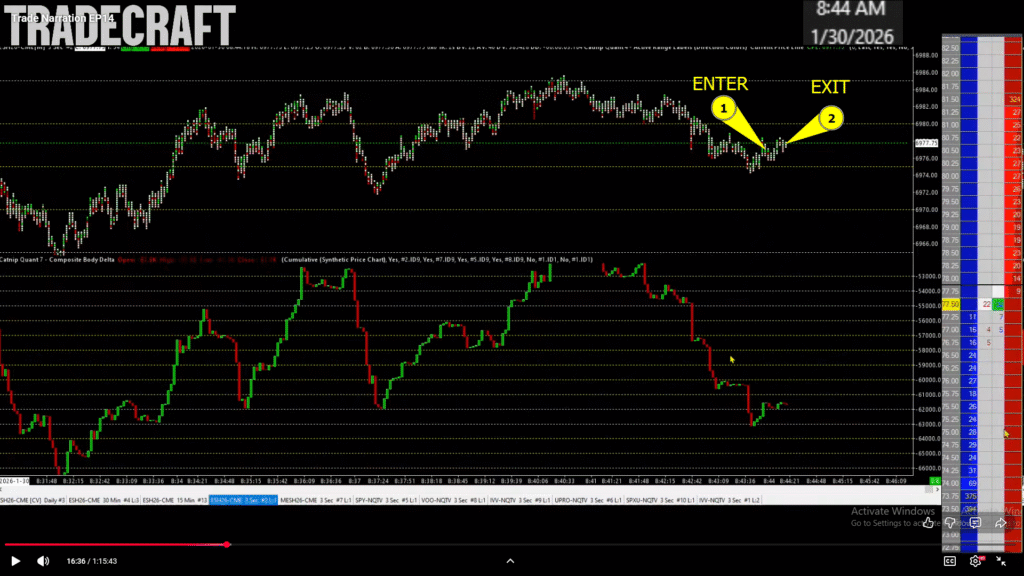

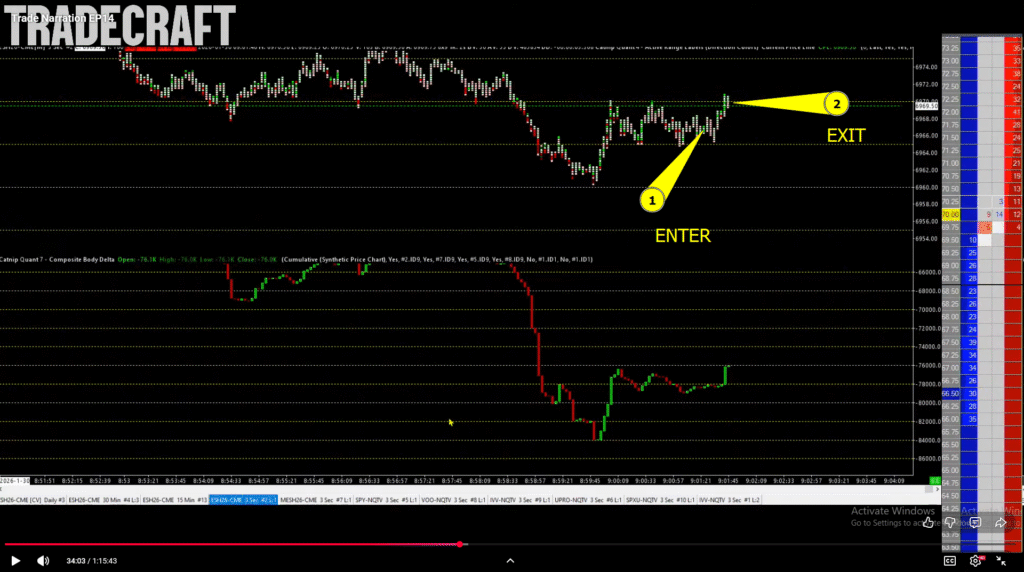

So I roll in. A little pep in my step. Feeling real good. Fire up the screens and as soon as the market opens the boomerang is setup. But the market just blasts through me. After all the market is volatile as fuck. I hold for a moment as the setup is still there but then it starts to fail. The volume starts to slosh. Basically the market can spoof on no volume and the volume lags in. So I see this sloshing and cut for a -$2634 loss.

Several seconds later another boomerang sets up long. I get in and sloshed. The volume bursts out low taking on another large loss putting me in the hole -$4780 yet I was confident. There’s a lot of volatility. I still felt fine and I’ve been in the shit hole on the open many times before and have managed to turn them around.

Trade 3 sets up a minute later; another boomerang, this time it works locking in +$2653 thus repairing half the loss.

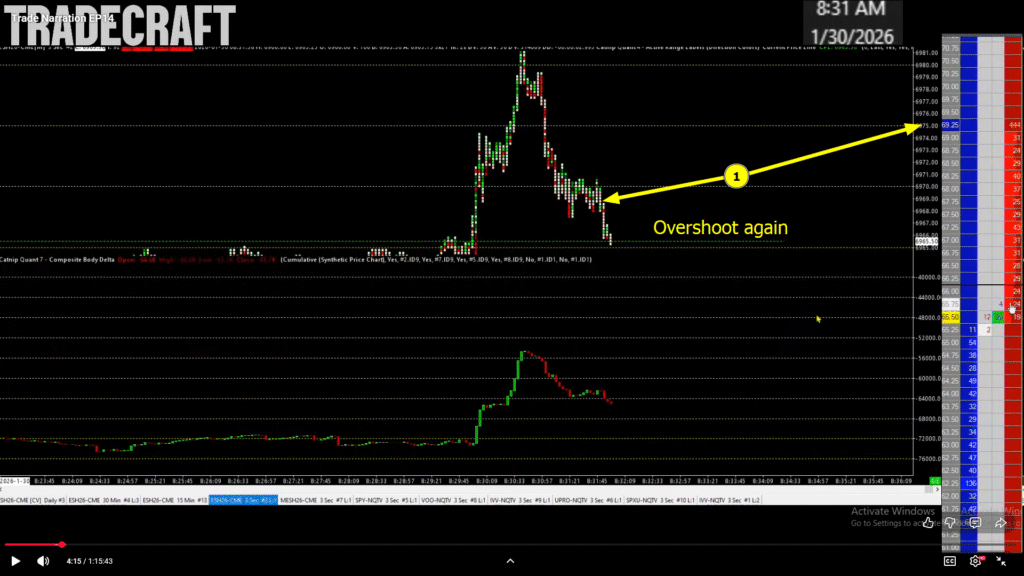

Trade 4 is another boomerang setting up high of day. I get in and it works instantly. I hold, then it comes in re-setting up for another boomerang. So the volume setup twice on my hold. This could potentially snap up hard but it then fails. It fails fast and hard going against me nearly 10 points. I freeze up a bit on this however the market v flushes back to entry. I notice this sloshing effect on the volume and start to lean into that a bit more. This is killing me but if I can lean into it I can get momentum. The market is spoofing which lag pulls this volume. There’s such huge inventory imbalance I sit in it. Now I don’t think this was the smartest trade. Something like this can get worse fast. However I notice the market sets up another boomerang right near me and I hold for another momentum pop. The market hesitates and sets up another boomerang flicking again up in my favor but now inventory is imbalanced against me so the market flushes back and I essentially bail for a break even.

Trade 5 the inventory starts shitting itself low and I know there’s a lot of reloading above me. So I figured there’s a ton of imbalance low, let’s ride the trend that seems to be forming. The market starts to back peddle after entry going against me 12 ticks then suddenly slams in my favor 12 ticks. Before I can even react the offers just disappear and the market starts instantly coming back to me so I bail for a 4 tick win. I was right but I couldn’t react.

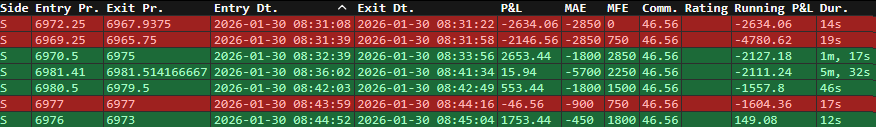

Trade 6 sets up for a short side boomerang I get in but the price stalls and floats a bit on my back side sort of bouncing. Not going far at all and I realize this thing is stalling too much and bail for a break even. The market is certainly tough but I feel good.

Trade 7 sets up for another downside boomerang in roughly the same spot. I get in and the fucking volume sloshes against me and this would normally be a failed setup but the book was balancing at this point. I had inventory favor to the low. As soon as I entered, the price stalled and sort of stabbed lower. I held and got a second wave of momentum as I noticed the book broke out and a ton of selling was coming in. A nice $1753 now at this point my rolling PNL is +$149. I had got back in the game after those two initial massive hits.

Trade 8 another boomerang to the downside this time it works fast scalping a quick point – at least that’s what I thought as the trade seemed to struggle to fill me. So I hit the flat key slipping some of the exit locking in +$440

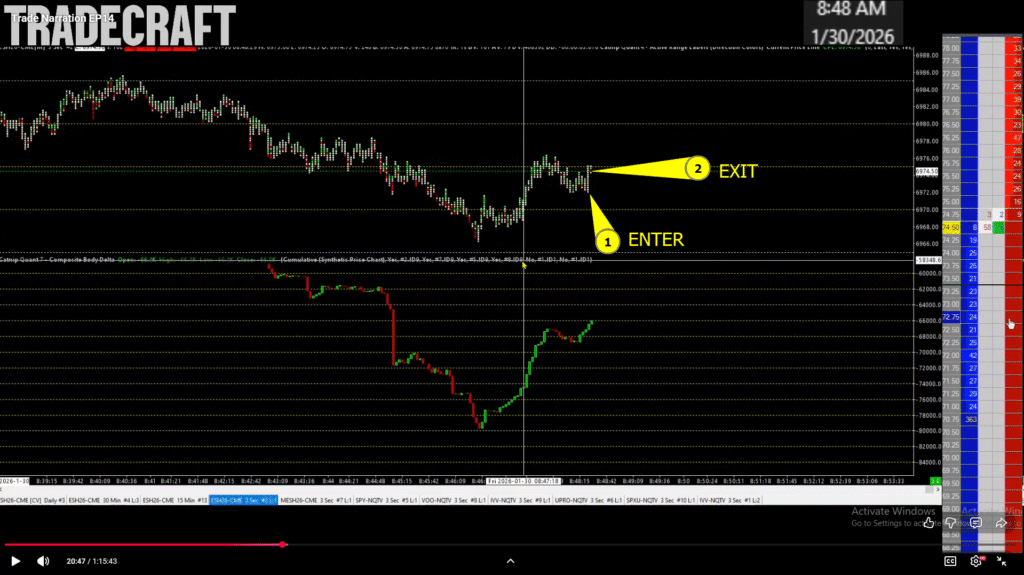

Trade 9 is a nice +$1153 as a long side boomerang sets up. This one just works fast in the right direction. Finally, I’m getting blessed with momentum here. However, the market is starting to lose volatility. This is a side note. I believe this setup struggles in higher volatility and when the market compresses into 3 point rotations it seems to come alive.

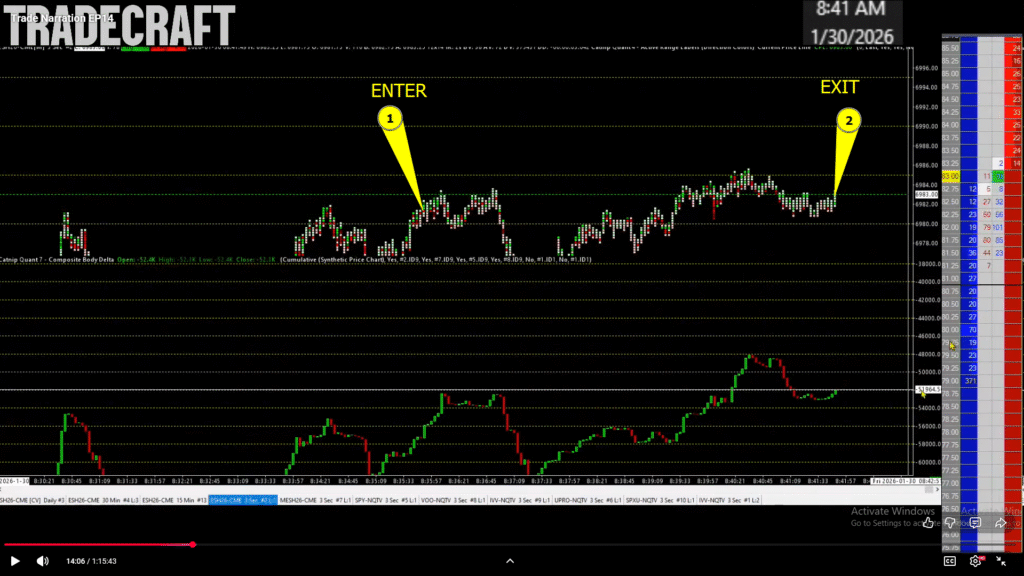

Trade 10 becomes a massive win. This is shortly after trade 9 where I had a boomerang. Well, I get a secondary boomerang setting up. So I go for it. The price starts to just sink against me slowly. Not a violent blow out. A slow sink going 2 points in the red before violently flicking up in my favor. I hold as the price comes back but again another boomerang set up. Then it flings up hard. I lock in +$4215 bring the running PNL to +$5959. This is not typical performance. At this point, my last 4 wins in row are just so good I’m in flow. I felt the need to keep going. When these situations happen, you should keep pressing because your clarity is high and these days can really offset losing days as you make the most of them. Too many traders just stop when things are good and keep going when things are bad.

Trade 11 I start to fumble. I go for another boomerang. This time the price floats below me. Just this gross stall I smash the flat key losing -$809 which is around 6 ticks. This isn’t a problem. Sometimes these things don’t work.

Now trade 12 is another loss, this one is bigger -$1246. This boomerang is a nice one. A big one. The price jumps in my favor about 5 ticks and I attempt to press for 8 ticks of profit. The price starts to erode back to me followed by a flirtatious push up. I desperately chase with limits to exit, hitting a limit every few ticks as the price just runs from me. The run is so steady, not fast but steady that the boomerang is no longer valid at this point. I have to cut it. Now my running PNL is +$3909 which is fine. Sometimes this happens. The setups stumble.

Trade 13 another boomerang this time when I get in it it flicks on both sides of me. Very odd behavior like there’s some rapid over correcting going on. However, when it flicks in my favor it stalls well into profit. I wait on this. Because if a trade wins quick and goes far, often times a little hold longer produces another leg up and that’s exactly what happened. I lock in +2203 recouping the last 2 losses plus some.

Trade 14 is another beautiful boomerang. Just chefs kiss of a setup. Price sloshes on me hard and then jumps back up. This time I hold a bit longer. It floats under me for 2 points. I continue to hold as I see 2 boomerangs setup. At this point I’m hoping it can flick back into me. Then a 4th boomerang sets up. I continue to hold forever as it keeps floating under me. a 5th boomerang. Price dumps adding a 6th boomerang. This thing is going against me pretty far eating at -$4200 which is roughly 7 points or so. But they keep putting in favorable setups; the price is just not ripping. I hold it and it just walks in my favor. Just a straight up trend locking in +$4153. That one was brutally intense in some ways. I‘m just up +$10,260 at this point on the run and instead of stopping I keep going.

Trade 15 is a short side boomerang; the price again goes against me and much like the last trade it boomerangs a 2nd time so what do I do? Hold. It struggles back and I decide to cut it for 4 ticks as it just seems like this could go to hell. The market was sticky.

Trade 16 is shortly after trade 15 with a boomerang long but this one has an extended leg on it. Very hardcore momentum potential. I go long and it bangs up fast and I lock in 8 ticks. Bringing the total run to $13,570.

Above is a screenshot from my TradeCraft journal.

Now is this setup magic? Not really. My max unrealized loss at one point around trade 4 was -$7827. I’ve since attempted this setup and it just is hit or miss. It seems to like a specific type of volatility and chop. Anytime trends are present, it will boomerang against the trend. It certainly has nuances like everything else. However it certainly can perform once you find it’s sweet spot.